[ad_1]

Fraud, especially the type perpetrated online, has become the most significant source of dirty money for Israeli criminals, according to a new report from the Justice Ministry’s anti-money laundering unit.

In its 2021 National Risk Assessment, released in late November, Israeli law enforcement agencies concluded that internet fraud poses the country’s biggest money-laundering risk, in terms of the prevalence of the crime and amount of money generated measured against law enforcement’s capability of thwarting it.

The report stands in contrast to the Money Laundering and Terror Financing Prohibition Authority’s (IMPA) previous report from 2017, which pointed to tax evasion, fictitious invoices and drug trafficking as Israel’s biggest money laundering problems.

The report is a periodic self-assessment that Israel is required to carry out as a condition of its membership in the Financial Action Task Force (FATF), a global anti-money laundering organization.

According to the 2021 report, “fraud and scams are exceedingly widespread and constitute a significant source of criminal income.”

“In our estimation, [internet fraud] has become one of the most lucrative criminal activities for organized crime groups in Israel,” the 2021 report said.

The 2021 report also cited fictitious invoices, drug trafficking and protection rackets as major money makers for Israeli organized crime groups, but ranked the ability of offenders to capitalize on those crimes as slightly lower. It did not provide numeric estimates for how much money each of these crimes generates. The report said that sex trafficking and physical theft, such as car theft and burglaries, have declined in recent years.

The report singled out two types of online fraud as particularly prevalent: phishing attacks against Israeli consumers and companies, as well as forex and other types of investment fraud against individuals abroad.

Phishing consists of ads, emails or text messages tricking a person into clicking a link or giving up personal information, allowing criminals to steal banking information or take over a victim’s computer.

Forex fraud features slick online trading websites that look legitimate. Call center agents induce investors around the world to deposit money in order to trade currencies, options or cryptocurrencies on the website, only to eventually disappear with investors’ money.

“The incidence of scams is very high,” the report said, “this includes forex fraud, which organized crime groups are involved in and that is carried out against citizens of foreign countries, including countries where the capabilities of law enforcement are low. The fraud money is often laundered in Israel.”

The report also found that as criminals have moved online, physical property thefts have decreased significantly, likely due to the fact that once prevalent burglaries and car thefts are less lucrative and carry a higher risk of being caught.

“There has been a 24.4 percent decrease in property crimes over the last five years,” the report said, referring to theft or damage to property in the physical world. “This decline is a worldwide phenomenon.”

Sex trafficking is likewise down, according to the report.

Assessing the risks

In December 2018, Israel joined the Financial Action Task Force, an international body that sets standards in the fight against money laundering and terror financing. The invitation to join came 18 years after Israel had been placed on an FATF blacklist of countries that were not taking steps to combat money laundering, a process by which money gained through illicit means is moved around to disguise its origin.

In the intervening years, as a condition of membership, Israel passed a slew of anti-money laundering laws and committed to carrying out periodic risk assessments that examine the ways Israel’s criminals are making money and how effectively the government prevents them from laundering it.

The FATF was founded in 1989 by the G7 summit in Paris and grew out of the United States’ efforts to crack down on the global drug trade and the realization that international cooperation was needed to track and forfeit the proceeds of transnational crime in a global economy. Global awareness of the need to combat money laundering increased after the September 11, 2001 terrorist attacks in the US and after several high-profile leaks in recent years about the way high net worth individuals store their money offshore.

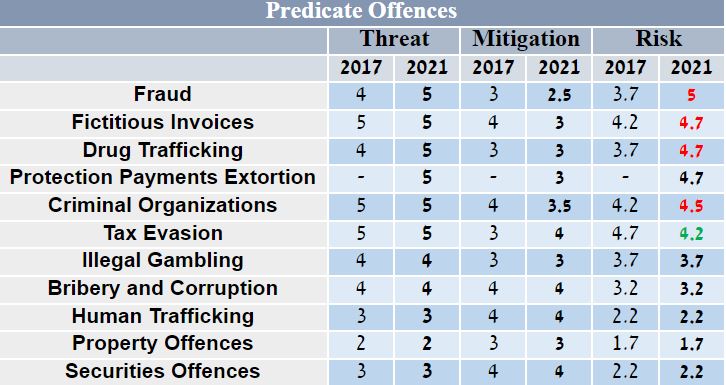

Israel’s 2021 report was compiled by IMPA, together with the Israel Police, the State Prosecutor, the Tax Authority, Securities Authority, and Competition Authority. It assesses the subset of Israeli crimes whose goal is financial gain and gives them a risk score between 1 and 5, based on how lucrative and prevalent they are on the one hand versus the ability or inability of law enforcement to tackle them on the other. According to this ranking, fraud now constitutes Israel’s greatest dirty money risk, along with unregistered money service businesses, as the greatest risk in terms of where money is laundered.

A heat map of Israel’s 2021 money-laundering risks, as assessed by Israel’s law enforcement agencies. (Courtesy)

According to the report, both senior Israeli organized crime figures and entities connected to terrorism have been involved in online scams.

“Israeli law enforcement data show that the scale of fraud and scams in Israel is very significant,” the report said, claiming that law enforcement have not been able to estimate the precise amount of money involved. “In our estimation, this has become one of the most lucrative criminal activities for organized crime groups in Israel.”

The report also claimed that online fraud is likely to grow due to the difficulty it poses for law enforcement.

“ Law enforcement’s ability to deal with internet fraud is low. A large percentage of complaints to police never mature into indictments due to the difficulty of establishing an evidentiary basis and the difficulty of locating the perpetrators when it comes to online scams. Another problem is that it is not possible to effectively enforce the law when the fraud activity is directed at citizens of foreign countries,” the report said.

The report also criticized a loophole in the 2017 law outlawing the binary options industry, a vast internet scam that stole billions of dollars from victims around the world.

While the law banned scams involving the financial instrument known as “binary options,” companies that changed their ostensible financial product to “forex” (betting on fiat currency fluctuations) and that targeted investors abroad with the same or a similar scam were not required to obtain a license or be subject to any sort of regulation in Israel.

“The law banning binary options contributed to deterrence in this area and the number of complaints related to binary options fraud has decreased dramatically,” the report said. “But the law did not address forex companies operating abroad that do not offer binary options.”

A table listing predicate offenses committed by Israeli crime groups and their threat score, according to Israeli law enforcement agencies. (Courtesy)

According to the report, Israel’s Money Laundering and Terror Financing Prohibition Authority receives frequent requests for information from financial intelligence units in at least 19 countries around the world.

The main crimes that are the focal point of these requests, the report said, are “money laundering, fraud, particularly investment scams, binary options and forex scams, bribery and corruption, forgery and illegal gambling.”

[ad_2]

Source link